Articles

Putting display matter one promotes your online business in your car doesn’t change the usage of the car out of individual use to company play with. If you utilize which car to have travelling or other personal uses, you continue to can be’t subtract their costs for these spends. Costs you only pay to playground your car or truck at your host to business try nondeductible driving expenditures. You could potentially, although not, deduct company-related vehicle parking fees whenever visiting a customer otherwise client. You always is also’t deduct the costs should your set aside conference is held to your day about what you wear’t work on your own regular employment. In this case, their transportation can be an excellent nondeductible commuting costs.

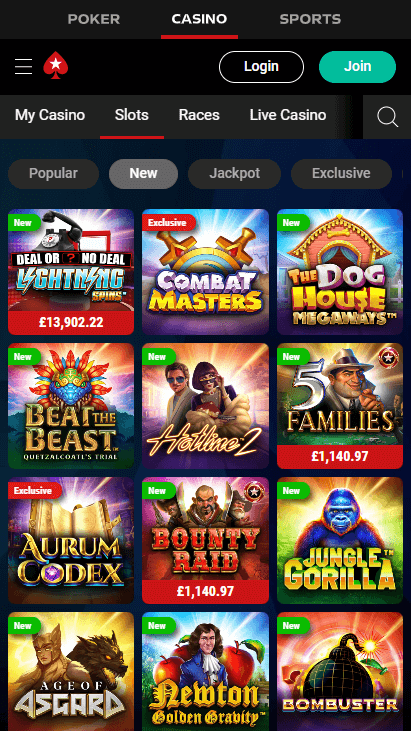

Casino at Cruise: Cracking Development

Fundamentally, a short-term task in one venue is just one that is logically anticipated to history (and really does actually history) for example 12 months otherwise shorter. You are employed by a transportation firm who may have its critical within the Phoenix. At the conclusion of your enough time works, you go back to your house critical within the Phoenix and purchase you to definitely evening here prior to returning house. You could’t subtract one expenses you may have to have food and you will rooms within the Phoenix or the price of take a trip of Phoenix so you can Tucson. For those who (along with your family members) don’t alive at the taxation home (discussed prior to), you could potentially’t deduct the cost of traveling between your taxation home and you can all your family members family.

What is the Taxpayer Suggest Service?

That it rule doesn’t implement when you have a real, independent organization experience of one family member plus the present isn’t meant for the customer’s eventual fool around with. For individuals who give presents during your own change or team, you might be capable deduct the otherwise area of the prices. So it part teaches you the fresh constraints and legislation to own deducting the expenses away from merchandise.

You need to make up all of the quantity your obtained from your own boss inside seasons as the advances, reimbursements, or allowances. This includes number your energized on the workplace from the charge card or other strategy. You should render your boss an identical sort of details and you will supporting information that you will have to give to the Internal revenue service should your Irs expected a good deduction on your own get back. You must repay the amount of one compensation and other debts allocation for which you don’t properly membership or that is more than the amount to own which you accounted. Among the legislation to own an accountable package is you need adequately membership for the workplace to suit your costs.

She has casino at Cruise composed and you may modified articles for the individual finance subjects to own over five years. Here are some a lot more things to watch out for in terms of a great financial sign-up bonus. A knowledgeable financial signal-right up incentives is also enable you to get various if not several thousand dollars for many who be considered. Keep in mind that the fee constraints one apply at Tier step one account perform notapply to help you Level dos membership.

It section demonstrates to you how to shape genuine expenses to own a leased car, vehicle, or van. You should is people too much depreciation on the gross income and you can include it with your vehicle’s adjusted reason behind the first tax season for which you don’t utilize the auto more 50% in the accredited team explore. Fool around with Mode 4797, Transformation from Organization Possessions, to figure and you will statement the additional depreciation on your gross income. If you continue to use your vehicle to have team after the recovery several months, you can claim a good decline deduction in the for each succeeding tax seasons if you don’t recover your own basis from the automobile. The most you can subtract every year depends on the brand new date your placed the vehicle in-service as well as your business-play with percentage.

Manage higher-give bank account costs change?

Meanwhile, banks have to prepare options and you can train staff to adhere to the brand new criteria — and given the complexity, actually waiting financial institutions can be deal with compliance chance. Scarcely a-year goes by instead major occurrences, if or not geopolitical, economic, or something like that totally unexpected for example a global pandemic, one significantly impression economic places, the fresh savings, and you will banking institutions. Just last year is no exception, and you will 2024 is on song to remain a difficult ecosystem — also without the totally unexpected surprises. An identical looks known as the Cops Assessment and you can Remark Administrator (PIRC) operates inside Scotland. Inside the North Ireland, the police Ombudsman to possess Northern Ireland have a similar part to compared to the newest IPCC and you may PIRC.

Not merely is anyone magnetic by using it, you can view the best graphics and you may crisp songs of the games. That is a journey away from finding and excitement that have satisfying honours, and also to give you wealth. The fresh reels could have the main characters, and there try right back tune songs while you play. If you’d like to mention mode away from vintage on the internet video game of poker, you then’ll getting pleased that have PlayAmo’s level of far more 20 internet poker games.

Within the quarter, put will cost you enhanced 6 foundation issues when you’re loan productivity refused 5 base issues. Mortgage efficiency have been impacted by a seasonal decline in mastercard financing. Determined by the produce-lows on the credit cards, the industry’s quarterly internet costs-from rate stayed in the 0.65 percent to your 2nd upright quarter, 24 base things more than the prior season’s rates. The current online charge-from rates are 17 foundation issues higher than the fresh pre-pandemic mediocre.

Boost your foundation from the any big improvements you make to your vehicle, such as incorporating air conditioning otherwise a different system. Lower your base by any area 179 deduction, special depreciation allowance, gasoline guzzler income tax, and you will car credits claimed. For those who replace the access to a car away from one hundred% personal use to organization fool around with in the income tax year, you may not provides mileage facts to your day through to the change to team explore. In cases like this, your profile the new portion of company play with to the season since the follows. For individuals who utilized the basic distance price in the 1st 12 months from team play with and change on the genuine costs approach in the a later on seasons, you could’t depreciate your vehicle underneath the MACRS legislation. You must fool around with straight line depreciation along side estimated kept of use longevity of the auto.

- An automobile boasts people area, role, and other goods individually linked to they otherwise always included in the price.

- However, by the very early 2024, banking institutions had sufficient places and you will been dialing straight back the interest cost they offered even as MMF efficiency remained more 5%.

- You could potentially ready yourself the fresh income tax return your self, see if you qualify for free income tax planning, otherwise get a tax professional to set up your own get back.

- HSBC has to offer sets from 0.70% to 1.45% p.an excellent., based on your own banking relationship with him or her.

However, when a student have withdrawn of college or university which can be maybe not thought to return, FWS fund might not be always pay money for work performed after the college student withdrew. A communication student need to submit the first finished example prior to getting a great disbursement beneath the FWS System. Your college or university can use any kind of payroll months they decides, offered people is paid at least monthly. It’s a good idea to feel the FWS payroll coincide to help you similar payrolls in the college or university.

Forbright Financial provides high production for the the put things, however, the Progress Family savings stands out particularly and offers competitive production to your people balance. The brand new membership might be exposed on the web, so there’s zero lowest beginning put demands. Forbright Bank try entitled a knowledgeable eco-friendly lender in the 2025 Bankrate Honors for the dedication to funding ecologically-amicable attempts. When you are trying to find doing more of your own banking at that eco-amicable lender, you could unlock certainly one of the Progress Cds online however, to get a bank checking account, you will have to check out a branch, many of which have Maryland. The fresh Ascending Bank Large Give Savings account also offers a competitive focus rates but a fairly high minimal beginning deposit from $1,000. You will additionally need to keep at least $step 1,one hundred thousand from the membership to earn the new APY.

Annual Report Financial Evaluation

It is important to define the fresh go out from disbursement since the several regulatory criteria depend on one to date. That is, an excellent disbursement have to be directly in regards to the true costs obtain from the scholar for this percentage several months. A college usually do not have fun with current Term IV finance to cover far more than $2 hundred within the earlier-season fees, even with students otherwise mother agreement ($200 overall, perhaps not inside for each and every payment period in the modern award 12 months). Charges for books and you may offers which might be institutional fees would also end up being prorated. Institutional costs are usually those to own university fees and charges, place and you will board, and other educational costs that are paid off for the college individually.