Anti-Money Laundering Laws to own Home-based A home belle rock pokie machine Transfer

By updating their cellar, forgotten, or any other space for the an excellent livable unit, you could entice rent-investing clients. You also is make an invitees household since the an ADU in the event the you have got sufficient free space on the possessions your already individual. An enthusiastic ADU is ways to buy a house you to doesn’t require that you purchase another possessions. The brand new demands might possibly be such burdensome, especially for small enterprises. Only one Revealing Individual was necessary to file a bona fide House Declaration to own a given transfer, and you may transfers that do not involve a reporting Person wouldn’t end up being included in revealing requirements.

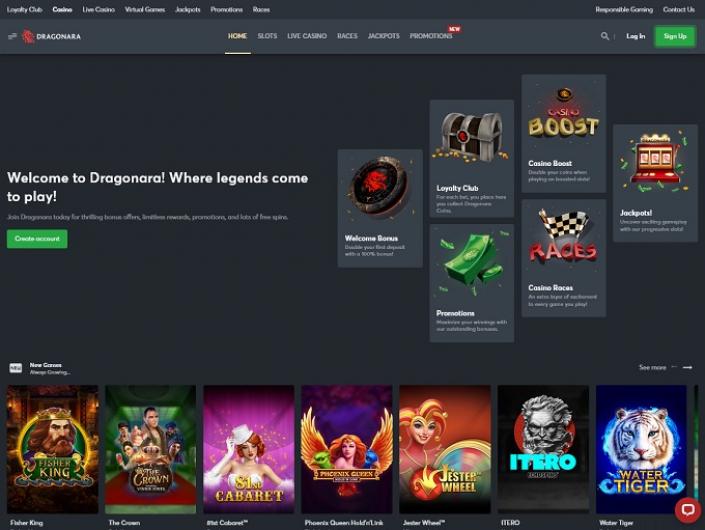

Belle rock pokie machine – Most residents favor paying by the debit, playing cards

Such tips are generally brought to make sure property is sensible for neighbors or perhaps to cool hot places. In a number of times, the newest laws and regulations manage uncertainty for designers and you can affluent people. Old-fashioned money away from a bank otherwise borrowing from the bank connection is greatly dependent to the fico scores, stated earnings, and stated debts. Difficult Currency or Personal money are mainly according to the underlying real-estate. Hard currency investment is fast and versatile, and will fit novel issues and you may quick timelines.

The goal is always to offer flexible, fast, and you may fair investment answers to make it easier to achieve your funding needs. Regardless if you are looking to to get, re-finance, or rehabilitate SFR’s, apartments, townhouses, or multifamily functions, our company is belle rock pokie machine right here in order to encourage your ability to succeed. Despite your position and condition, we are able to most likely help you find a simple solution to suit your actual home investment. Difficult money industrial money is actually private finance accustomed and acquire industrial kinds. Unlike a conventional mortgage, a hard currency mortgage comes with a lot fewer limits and much more independency.

Searching for Much more Choices? Imagine REITs

Personal currency lenders generally wanted a down payment with a minimum of 25%. That it advance payment requirements is usually greater than what’s expected from financial institutions and you can credit unions but the trade off is that personal money loan providers features far fewer standards to possess loan recognition. Also they are in a position to neglect bad credit and other points to the a borrower’s number such as foreclosures, bankruptcies and you can quick sales. For the August 28, 2024, the newest Agency of your own Treasury’s Financial Crimes Administration Circle (FinCEN) provided a last signal (RRE Rule) carrying out a reporting regime for transfers from residential a house. That it RRE Laws, recommended inside the initial form on the February 16, 2024, supplements FinCEN’s latest Standard Targeting Buy (GTO) system to have reporting of these purchases but is a bit various other inside the approach and you may scope.

- As the seems to be a continual world pattern, Hard rock’s advertising selection isn’t since the deep as it had previously been.

- Private lenders essentially provide funding to own sixty-70% of your property’s once-repair value (ARV), making sure you can over home improvements effectively.

- Tough currency domestic fund come with book benefits and drawbacks, making them a popular selection for particular however right for group.

- Investors need evaluate its monetary features and you will entry to funding.

- The newest RRE Laws demands a closing/payment agent within the a protected transaction doing and you will yield to FinCEN a bona-fide Estate Report which have certain factual statements about the order.

This includes information about obtained possessions and you may management’s perspective to the stability and gratification out of specific a home investment so when an asset classification. Investment teams (REIGs) are sort of such as quick common fund for rent functions. If you want to individual a rental assets but wear’t need the hassle of being a property owner, a genuine estate funding classification will be the services to you.

Regular business hours

Following, once they’ve obtained the concept of it, they’ll expand their funding portfolio. You might think challenging initially, nonetheless it acquired’t be because the daunting once you acquire feel and higher learn the various sort of home. Keep reading on the Frequently asked questions the majority of people provides after they think earning profits in the real estate industry. There’s another misconception that you need to establish significant possessions to help you secure an agreement otherwise purchase some assets. Your wear’t should do it, however you need to recognize how innovative financing works. Most people only stop inactive within their tracks while they have that it religion about what needed to have been.

ResidentPay offers a whole fee solution for mastercard, electronic consider (ACH), cash/money order and look reading. Couple ResidentPay having My Genuine Functions’s possessions administration application or other assets administration app and possess immediate and automated post for the ledger. In the event of a dispute regarding the Services, you and i agree to care for the new disagreement from the seeking to which Arrangement.

I reserve the ability to transfer otherwise designate so it Arrangement or any best or obligations under that it Arrangement any time to help you people team. We may and designate otherwise subcontract certain of the legal rights and requirements lower than that it Contract to help you separate designers or other businesses. Which Agreement set onward the whole information ranging from united states and you also according to the Solution plus the portion of the Webpages whereby this service membership is out there.

Individual money mortgage lenders – Personal difficult currency money

I zeroed inside for the key factors for example use of, mortgage diversity and you may closure rate, because if you’lso are making an application for a challenging currency loan, with money in give As quickly as possible can be important. Difficult money domestic financing try small-name investment choices shielded from the home rather than your own borrowing get otherwise financial character. Such financing are predominantly backed by individual loan providers or individual currency loan providers and therefore are available for aim such as a house opportunities, fix-and-flip projects, otherwise bridging economic openings. Illegal actors appear to exploit low-funded (all-cash) a property transactions, specially when house is obtained due to court organizations or trusts.

A skilled property owner or a house innovation firm serves as the overall companion. External people try up coming wanted to add investment to your genuine property investment, in exchange for a portion of control while the minimal people. Like the day people who are leagues of pick-and-hold buyers, a home flippers is actually a completely additional breed away from get-and-lease landlords. Flippers buy features to your aim of carrying him or her to have a great short period—usually only about three to four weeks—and you can rapidly offering him or her to possess a return. Another first way that landlords make money is through enjoy. If your possessions appreciates within the value, you might be capable sell it in the a return (when the time comes) or borrow secured on the fresh collateral and then make your following investment.