Blogs

This informative guide examines 50 type of witches, offering understanding of the newest practices, philosophy, and you will equipment which make every one unique. Whether you’re a new comer to witchcraft otherwise a seasoned practitioner, understanding this type of routes get motivate and you may deepen their enchanting travel. Witchcraft try a highly diverse and you may old habit one to continues to develop and adjust over the years. There are numerous pathways to have witches to follow, for each using its own book interest and effort.

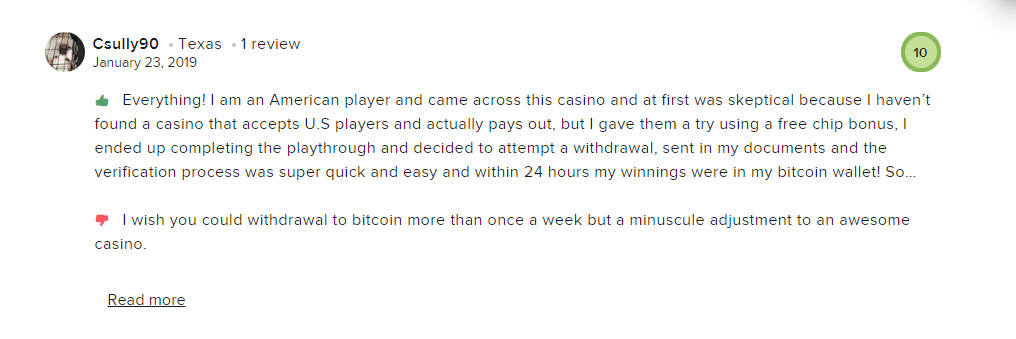

7sultans casino – Other Ambulatory Health care Functions

Through the partner’s distributive display out of income tax-excused income because of the partnership to make an optional fee election under point 6417. Have the brand new partner’s distributive express of allocations to the partnership from an admission-as a result of entity (or down-level ticket-thanks to organization) one produced an optional fee election. If any part of the changes is actually allocable to help you web quick-name funding get (loss), net long-name financing gain (loss), or internet point 1231 gain (loss), attach a statement one refers to the degree of the fresh variations allocable to each form of acquire or loss.

Changes away from income tax season.

Find area 465(b)(6) for additional info on certified nonrecourse funding. In case your get back is for a fiscal year or a primary taxation year, fill out the new tax year area towards the top of for each Agenda K-step one. On each Agenda K-1, go into the details about the relationship plus the companion inside Bits I and you will II (things A from N).

Enter into for every partner’s distributive display of your most other earnings groups noted earlier inside the field 11 away from Schedule K-step one. Acquire otherwise losses on the feeling of ranch recapture assets or any other things to and that section 1252 enforce (password P). Through the number of earnings the connection have to recognize for a transfer out of a partnership interest in fulfillment of a collaboration financial obligation in the event the debt relieved is higher than the fresh FMV of the connection interest.

App help

Its practice usually comes with necromancy, divination, and dealing to your comfort of 7sultans casino one’s dead. Limbs witches view bones because the effective conduits of lifestyle and you may thoughts, carrying the fresh essence ones which existed prior to. They could hobby talismans otherwise play with bones within the traditions to help you tap to the deep expertise and conversion process. Which street emphasizes the new cyclical characteristics from existence, death, and you will resurgence. Tree witches is actually seriously linked to the energy away from woodlands, attracting strength of trees, moss, plus the spirits of your own tree.

Although not, you could potentially scour from official socials to discover the requirements alone. The Comic strip Finally Hit Dissension server as well as the Yappers Studios Roblox groups will be the best urban centers to find the operating of these. If you are regarding the Dissension host, visit the announcements route and acquire the codes. Keeping up with the new rules because of it experience is super easy while you are for the our webpage.

During the period of the fresh eighteenth and you can 19th many years, various Eu states altered or repealed laws and regulations one to criminalized witchcraft, mainly finish that point out of courtroom prosecutions. Whilst the witch samples was more, a concern with malicious witchery persevered in lots of groups. In numerous urban centers allegations and uncommon attacks to the accused witches continued to your 20th 100 years.

- They consider witchcraft since the a functional and you may mental equipment for personal development and you may purpose-setting.

- Go into the earnings (loss) regardless of (a) the brand new bases of your own partners’ passions from the connection, (b) the newest partners’ in the-chance restrictions, or (c) the new inactive activity constraints.

- Possibilities trust your purchase matter, can differ by merchant, get believe if the loan are applied for prior to or just after your own Cards buy, and may also never be available in the claims.

- Enter the sum of the brand new modified income tax basics out of property web from liabilities distributed to for every companion by partnership while the mirrored on the partnership’s instructions and you may info.

- A foreign union that have You.S. source earnings actually needed to file Setting 1065 if this qualifies to have possibly of your own pursuing the a couple of exclusions.

- See, essentially, the fresh Instructions to have Form 4562 for much more home elevators the newest part 179 bills deduction.

All Active Cartoon Final Strike Rules

Critics of several well-known women politicians energetic inside the Anglophone communities, such Margaret Thatcher or Hillary Clinton, provides known them as the witches as an easy way away from humiliating them. As the so it utilization of the label witch is used simply up against girls rather than against males, it could be argued that it’s at some point misogynistic inside intent. The newest broadening of the phrase witch comes ultimately away from Christian polemical books. Within the medieval and you will very early progressive Europe, of a lot Christians engaged in routine tips, if or not for healing, for carrying out amulets, or discovering lost possessions, that have been outside the remit of your church government. Those people engaged in such as techniques often thought that the brand new supernatural pushes these were invoking originated in Christian theology; of several registered charms invoke the efficacy of Christ, the fresh Virgin Mary, as well as the saints, such as.

Structural, Technologies, and you will Relevant Services

Gaming development and you may loss subject to the brand new constraints in the section 165(d). Indicate to the an affixed report whether or not the partnership try in the change or organization out of gambling. Figure the entire of those number for everybody area 1250 features.

Have people suggestions expected by someone to find the attention due below section 453(l)(3). It represents gain otherwise losings for the sale, change, or other feeling out of property in which a section 179 deduction has been passed on partners. The relationship ought to provide all of the following guidance associated with such as dispositions (understand the guidelines to have web page 1, range 6, earlier). Attach to for every Agenda K-step 1 a new declaration offering the information the partnership is needed to show on the Setting 4255, however, number precisely the partner’s distributive show of the cost of the house subject to recapture. Along with indicate the newest outlines away from Function 4255 about what the newest people will be declaration this type of quantity.

If recapture of part otherwise the lower-money homes borrowing from the bank is needed as the (a) the last 12 months accredited base away from an establishing decreased, otherwise (b) the partnership thrown away a building otherwise element of their desire inside the an establishing, find Setting 8611, Recapture from Low-Money Property Borrowing. Over Setting 8611, contours step one because of 7, to search for the quantity of credit to capture. Have fun with code F to your Schedule K-1 to help you statement recapture of your low-income houses credit from a paragraph 42(j)(5) relationship.

Should your business sales recycleables and you may provides these to an excellent subcontractor to create the new finished device, however, holds identity to the device, the business is regarded as a manufacturer and ought to fool around with one of the fresh development rules (311110–339900). To own partnerships necessary to file Plan Meters-3, the fresh numbers claimed on the Agenda L have to be numbers away from monetary comments always complete Plan Meters-step 3. Should your relationship makes non-tax-basis economic statements, Agenda Yards-step three and Schedule L need to statement low-tax-basis statement of finance quantity. If the union doesn’t ready yourself non-tax-basis economic comments, Agenda L should be according to the partnership’s courses and details and could let you know tax-foundation balance piece numbers in case your partnership’s courses and you can info reflect only taxation-base amounts. Mode 8990, Agenda An excellent, demands particular international people to declaration their allocable express of EBIE, excessive nonexempt earnings, and you will an excessive amount of business attention income, if any, that is attributable to income effectively associated with an excellent U.S. trading otherwise organization.

What’s more, it brings together various other social networking programs and you will instantaneous messengers very you could availableness WhatsApp, Fb Messenger, X.com (earlier Twitter), Instagram, and you can YouTube directly from the new web browser user interface. Much like almost every other alternatives, you could coordinate their discover tabs and other investigation anywhere between gadgets immediately thanks to Opera Contact. You could potentially discover numerous tabs and you may create him or her as you like, which includes collection tabs as well as collapsing the whole classification to help you your own favorites bar, so they really never digest your pc info and can be easily exposed again as soon as you must. Created by the new technological icon, Google Chrome is considered the most well-known options when it comes to internet explorer, whether or not we have been talking about individual or elite group fool around with or having they to your a pc or a smart phone.

To find the restrict percentage possessed in the partnership’s profit, loss, or money to your reason for questions 2a, 2b, and you can 3b, determine separately the brand new partner’s portion of need for money, losses, and you will money at the conclusion of the fresh partnership’s tax seasons. So it dedication must be based on the connection contract also it must be produced by using the useful ownership laws revealed lower than. Maximum fee ‘s the large of these about three proportions (computed at the end of the brand new tax year). Never were numbers repaid inside income tax season for insurance rates you to definitely constitutes medical care to own somebody, a good partner’s partner, a partner’s dependents, otherwise an excellent lover’s students less than many years 27 who aren’t dependents.