Understanding Prop Trading in Forex Markets

Proprietary trading, commonly referred to as prop trading, has gained traction in various financial markets, particularly in the forex market. This form of trading involves firms using their own capital to trade for profit, as opposed to trading on behalf of clients. This article delves into the intricacies of prop trading in forex, examining the benefits, risks, and strategies essential for success. If you’re exploring your options, you might consider reviewing prop trading forex Bangladesh Brokers for insights on available trading services.

What is Prop Trading?

Prop trading is a practice where financial firms or individual traders use their own funds, as well as those of their owners, to conduct market transactions. This differs from traditional brokerage firms, which usually trade using client funds and earn commissions on those trades. Prop trading firms typically keep any profits gained from their trades, which makes them highly incentivized to develop effective trading strategies and risk management techniques.

How Does Prop Trading Work?

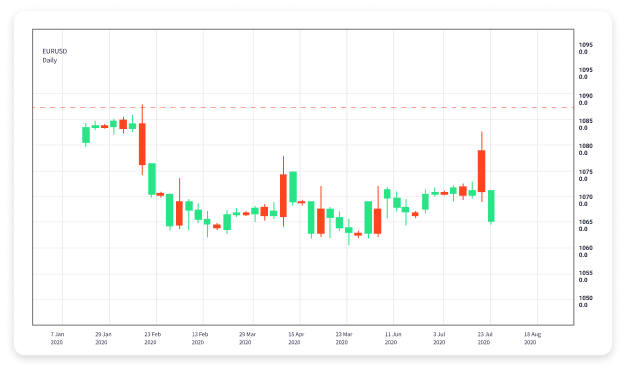

In the context of forex, prop traders speculate on currency pairs, aiming to take advantage of market fluctuations to turn a profit. These traders often employ a variety of trading strategies, including day trading, swing trading, and algorithmic trading. The strategies used can vary significantly based on the trader’s expertise, market conditions, and overall goals.

Prop trading firms typically recruit traders who showcase a sound understanding of the forex market and strong trading skills. Once selected, these traders are provided with access to the firm’s capital, resources, and sometimes proprietary trading platforms. In return, the firm takes a portion of the profits made by the trader while also covering potential losses up to a certain limit.

Advantages of Prop Trading in Forex

There are several benefits associated with prop trading, particularly in the forex markets:

- Capital Efficiency: Prop firms often provide significant capital, allowing traders to leverage their financial resources for larger trades without risking personal funds.

- Access to Tools and Resources: Many prop trading firms offer advanced trading platforms, analytical tools, and educational resources that can help traders develop and refine their strategies.

- Lower Psychological Pressure: Since traders are not trading their own money, the emotional burden often associated with financial loss is somewhat alleviated, allowing for more objective decision-making.

- Profit Sharing: Successful prop traders can earn a substantial income through profit sharing, which can be more lucrative than working for traditional brokerage firms or trading independently.

Risks Associated with Prop Trading

While prop trading has its advantages, it’s crucial to understand the associated risks:

- Market Volatility: The forex market can be extremely volatile, and traders can incur significant losses if market movements are not anticipated correctly.

- Pressure to Perform: Prop traders often face high expectations from their firms, which can lead to stress and impulsive trading decisions.

- Potential for Losses: Traders may not only lose their profits but also be penalized for losses incurred while trading the firm’s capital.

- Regulatory Challenges: Operating within the forex market may expose prop trading firms to various regulatory requirements, which can affect trading strategies and operations.

Key Strategies for Success in Prop Trading

To excel in prop trading, especially in the forex market, traders should consider the following strategies:

- Develop a Solid Trading Plan: Successful traders have clear, defined strategies that detail when to enter and exit trades, including criteria for risk management.

- Master Technical Analysis: Understanding technical indicators and chart patterns is fundamental to anticipating market movements and making informed decisions.

- Stay Informed: Keeping updated with global economic news, geopolitical events, and market sentiment can substantially enhance trading outcomes.

- Practice Risk Management: Implementing strict risk management rules, including setting stop-loss orders and adhering to position sizing guidelines, can help protect trading capital.

Getting Started with Prop Trading

If you’re intrigued by the potential of prop trading in forex, consider the following steps:

- Research and Select a Prop Trading Firm: Evaluate various prop trading firms to find one that aligns with your trading style, risk tolerance, and financial goals.

- Complete the Application Process: Prepare your resume, trading history, and any certifications to apply for a position with a prop trading firm.

- Develop Your Skills: Utilize the resources provided by your firm and pursue ongoing education to refine your trading strategies and risk management techniques.

- Start Trading: Begin trading with capital provided by the firm, applying the strategies you have developed while adhering to the firm’s protocols and guidelines.

Conclusion

Prop trading in the forex market presents a unique opportunity for traders to utilize significant capital while refining their trading strategies in a structured environment. While it carries inherent risks, the potential rewards can be substantial for those who approach it with the right mindset, skill set, and dedication. As with any trading approach, the key to success lies in continuous learning, disciplined trading, and effective risk management. If you’re ready to embark on your prop trading journey, ensure to choose the right partners and stay informed about market trends and trading strategies.